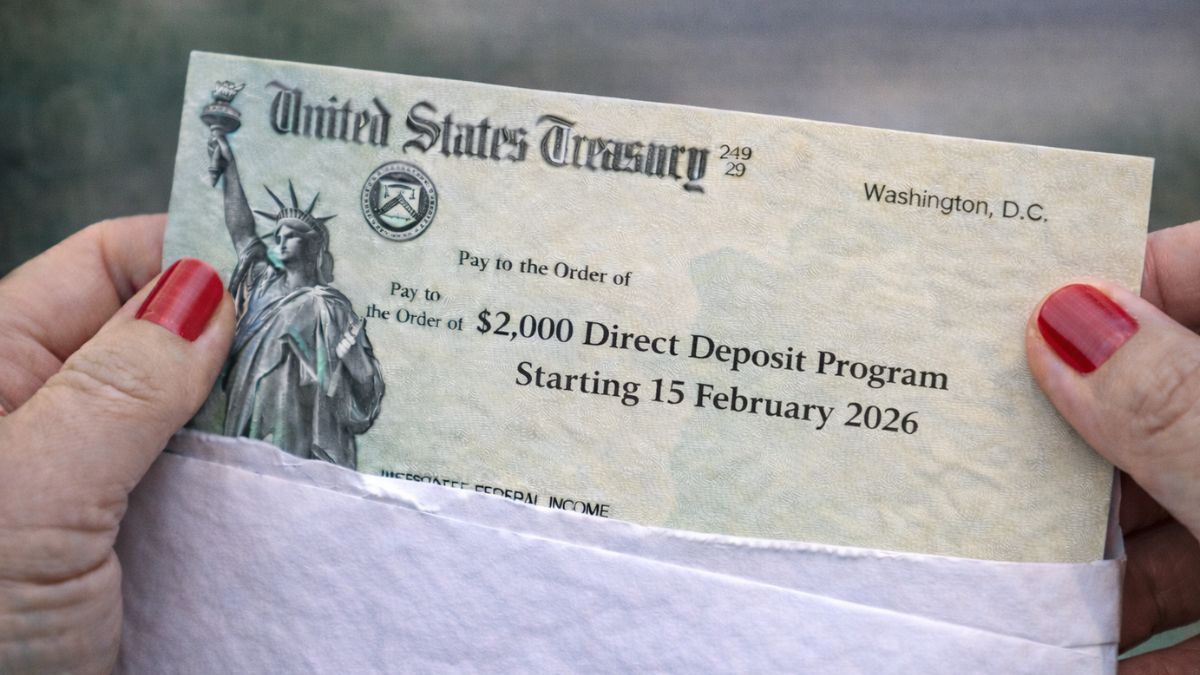

IRS Confirms $2,000 Direct Deposit for February 2026: In early 2026, many online posts claimed that the Internal Revenue Service had confirmed a $2,000 direct deposit for February. These messages described fixed payment dates and clear eligibility rules. Because living costs remain high, it is understandable that such news gained attention quickly. However, based on official government records, there is no newly approved nationwide $2,000 stimulus payment for February 2026.

No New Stimulus Has Been Approved

At this time, Congress has not passed any law authorizing a universal $2,000 payment. Federal stimulus checks in the past required formal approval from Congress and the President. The IRS cannot create or send nationwide payments unless a law directs it to do so. Without legislation, there is no new federal program providing a flat $2,000 deposit this month.

This means that any money arriving in bank accounts during February is most likely related to tax refunds. A tax refund is not a stimulus check. It simply returns money that a taxpayer overpaid during the year through withholding or estimated payments.

Why Refunds Are Being Confused With Stimulus Checks

The 2026 tax season for the 2025 tax year opened in late January. Many taxpayers who file electronically and choose direct deposit receive refunds within two to three weeks. For families claiming refundable credits, refund amounts can sometimes exceed $2,000. When these deposits arrive in mid or late February, some people mistake them for new federal relief payments.

In reality, refund amounts depend on income, filing status, tax withheld, and credits claimed. Two households with similar incomes may receive very different refunds. There is no fixed amount guaranteed to every taxpayer.

How Refund Eligibility Actually Works

There is no separate application for a $2,000 February payment because no standalone program exists. Refund eligibility is based entirely on the information reported on a tax return. Important factors include adjusted gross income, filing status, total withholding, and refundable credits.

Returns must include accurate Social Security numbers and correct banking details. If errors or mismatches appear, the IRS may delay processing. Taxpayers who have not filed a return should not expect any automatic federal deposit under current law.

Stay Informed Through Official Sources

The safest way to check refund progress is by using the official IRS tracking tool. Avoid relying on social media posts, emails, or text messages promising guaranteed deposits. Misinformation spreads quickly during tax season, especially when refund amounts are high.

Disclaimer

This article is for informational purposes only and does not provide legal, tax, or financial advice. There is no confirmed universal $2,000 direct deposit program for February 2026. Refund amounts and timelines depend entirely on individual tax records and official IRS procedures. Always verify information through authorized government sources.